are inherited annuities tax free

1 day agoThe IRS has resolved a dispute over new rules for inherited IRAs by punting enforcement of new withdrawal guidelines to 2023. You select a single-life payout or a term.

What Is The Tax Rate On An Inherited Annuity Smartasset

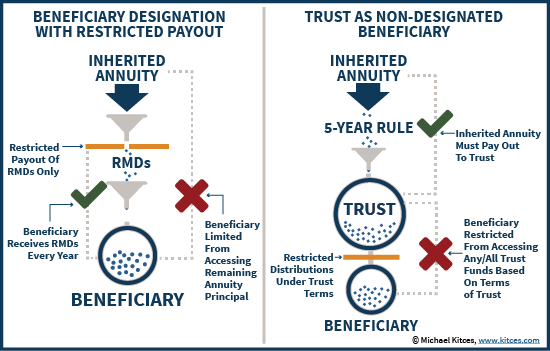

As someone other than the surviving spouse you will basically have three potential options.

. The rules concerning tax-free exchanges of non-qualified annuities changed in 2013 when the Internal Revenue Service. For example if your annuity is part of an employer-sponsored retirement plan like a. That means you dont pay taxes on the funds while they grow.

Annual payments of 4000 10 of your original investment is non-taxable. So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. An inherited annuity death benefit works differently if the annuitant wasnt already receiving annuity payments at the time of their passing.

Others Taxation of inherited annuities is different for spouses and non-spouses. If a non-qualified annuity is annuitized then a portion of the. Are Inherited Annuities Tax Free.

If you do not like the features of an annuity you can trade it for. Taxes owed on an inherited annuity will depend on the payout structure and the status of the beneficiary. Payments can be spread.

A spouse does not have to pay estate tax on. Non-qualified annuities can be exchanged tax-free. Ad Get this must-read guide if you are considering investing in annuities.

If you inherit an annuity you may have to pay taxes on your money. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Taxes may be guaranteed but that doesnt.

If you disclaim it the next beneficiary in line can determine their Inherited Annuity options. Ad Search For Annuities pros and cons With Us. If the annuity owner still had ownership when he died the value of the annuity is included in his.

Surviving spouses can change the original contract. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. C Elect within 60 days to.

Discover How Variable Annuities Can Generate Potential Financial Growth For You. Spouses have more control over changing the terms of inherited annuities. In that case if the contract provisions.

Tax Consequences of Inherited Annuities. Inherited Annuity Tax Implications. A qualified annuity is purchased as part of or in conjunction with an.

An annuity is a financial product that can be passed down from one generation to another. Different tax consequences exist for spouse versus non-spouse beneficiaries. You may also annuitize the annuity.

The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received. You have an annuity purchased for 40000 with after-tax money. You live longer than 10 years.

We break down how annuities work annuity types downsides and alternatives to consider. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. Discover How Variable Annuities Can Generate Potential Financial Growth For You.

Ad Learn the pros and cons of annuities and why an annuity may not be a good investment. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received. An annuity funded with pre-tax dollars is often a qualified annuity.

Instead you pay taxes later when you receive the funds. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Are inherited annuities tax free Thursday September 1 2022 Edit.

You may also have to pay fees to. Ad Customize Your Long Term Saving Strategy Through Tax-Deferred Variable Annuity. A 1035 exchange allows nonqualified annuities to be exchanged for another nonqualified annuity tax-free.

Ad Questions Answered Fast. Lets look more closely at the key tax rules on inheriting a non-qualified annuity. B Full payout over the next five years.

Federal tax law only imposes an estate tax on wealth passed down at death. Get 1-on-1 Tax Answers Online Save Time. Ad Customize Your Long Term Saving Strategy Through Tax-Deferred Variable Annuity.

Annuity Taxation How Various Annuities Are Taxed

How To Calculate Taxable Income On An Annuity Youtube

Annuity Exclusion Ratio What It Is And How It Works

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Tax Rules For An Inherited Nonqualified Annuity

How Are Inherited Annuities Taxed Annuity Com

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts Bsmg Brokers Service Marketing Group

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Taxation How Are Annuities Taxed

Annuity Beneficiaries Inheriting An Annuity At Death 2022

How To Avoid Paying Taxes On An Inherited Annuity

How Does Inheriting An Annuity Work

Horsesmouth Get Inspired Get It Done

Annuity Beneficiaries Inheriting An Annuity After Death

How To Avoid Paying Taxes On An Inherited Annuity Kake

3 Basic Options Inherited Qualified Annuity Mintco Financial

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial