are raffle tickets tax deductible irs

Marys Oratory is a 501 c 3 receipts are not available for the donation because IRS tax code does not consider raffle tickets tax deductible. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket.

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

. The IRS has determined that purchasing the chance to win a prize has value that is essentially equal to the cost of the raffle ticket. Exempt under section 501 of the Internal Revenue Code. The IRS has special rules for bingo.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. After purchasing the ticket but before the raffle drawing the individual gives the ticket to the church or lists the church on the ticket as the beneficiary if the ticket is drawn. The IRS explicitly prohibits deducting the cost of raffle tickets as a charitable contribution presumably because it does not consider the cost of the.

Costs of raffles bingo lottery etc. If you buy 20 worth of tickets and win a 100 prize for example you can take a 20 deduction. Are raffle tickets tax deductible IRS.

Dont send tax ques-. Raffle sponsors keep tickets under wraps until the drawing. The organization may also be required to withhold and remit federal income taxes on prizes.

The IRS considers a raffle ticket to be a contribution from which you benefit. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. For information on how to report gambling winnings and losses see Deductions Not Subject to the 2 Limit in Publication 529.

A tax-exempt organization that sponsors raffles may be required to secure information about the winners and file reports on the prizes with the Internal Revenue Service. Hilby says that even though St. Can the cost of the raffle tickets from a nonprofit be deductible as a donation gambling loss or not at all if I did not win.

Unincorporated Nonprofit Association vs. The church holds the raffle drawing and the church draws the winning ticket. The result of this is that individuals whose purchases involve raffle tickets items or food cannot benefit from an income tax deduction.

Is Raffle Ticket Tax-Deductible. Income from games of chance may be considered unrelated business income and therefore the charitable nonprofit may owe tax on the income and winners may owe tax that the nonprofit is required to withhold. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

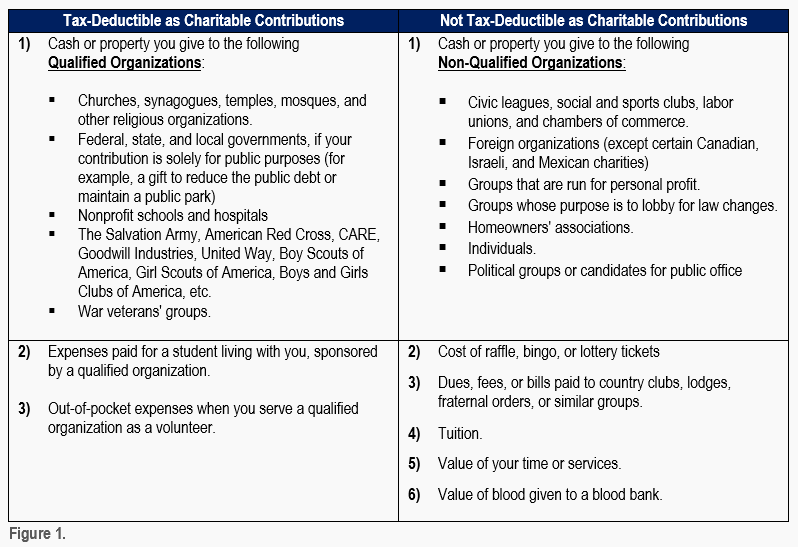

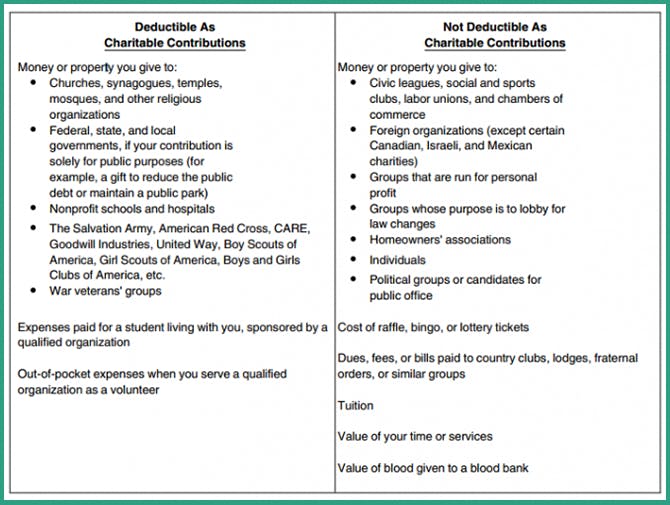

In some cases a portion of the payment made by the donor may qualify as a. Regular donations to am yisrael chai are tax deductible in the usa but according to the irs raffle tickets do not qualify for a deduction and are therefore not tax deductible. You cannot deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.

An individual purchases a raffle ticket in a church-sponsored drawing. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable donation. You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.

Dear Tax Talk A nonprofit lets call it X has a raffle with 125 tickets and a 5000 first prize. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket.

The IRS allows you to write off gambling expenses but only up to the amount of your winnings. If you lose and dont have other winnings you cant claim anything. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket.

One way to write off your raffle ticket is as a gambling loss. Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms instruc-tions and publications. If youve formed an unincorporated association for the purpose of doing public good incorporating as a nonprofit corporation or applying for IRS tax.

If you itemize you can only deduct gambling losses against winnings and youre not allowed to claim raffle or lottery tickets as a charitable deduction. The Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Read the IRS notice about reporting requirements and income withholding for raffle prizes.

As I understand the taxes the first prize win is. May 03 2021 3 min read. Are raffle tickets tax deductible IRS.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Raffles tickets arent deductible as charitable donations even if the tickets are sold by nonprofitsTickets for raffle are treated as contributions by the IRS that benefit you. If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive.

The revenue ruling holds that the purchasers of the raffle tickets may not deduct the cost of the tickets as charitable contributions under IRC 170. NW IR-6526 Washington DC 20224. Unfortunately fund-raising tickets are not deductible.

For information on how to report gambling winnings and losses see Expenses You Can Deduct in Pub.

Are Raffle Tickets Tax Deductible The Finances Hub

A Quick Guide To Deducting Your Donations Charity Navigator

Tbt A Night In Old Havana Gala Bsaz Creates Havana Nights Party Havana Nights Theme Havana Nights

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

A Quick Guide To Deducting Your Donations Charity Navigator

Hannah S Treasure Chest Fundraising Letter Donation Letter Fundraising Letter Fundraiser Help

Free Vehicle Donation Receipt Template Sample Word Pdf Eforms

Are Raffle Tickets Tax Deductible The Finances Hub

Kcl Tax Tips How To Maximize Your Tax Deductions For Charitable Contributions The Krazy Coupon Lady

Are Raffle Tickets Tax Deductible The Finances Hub

Are Charity Auction Items Tax Deductible Travelpledge News

A Quick Guide To Deducting Your Donations Charity Navigator

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Free Printable Printable Ch Small Business Tax Business Tax Deductions Business Tax

Tax Deductions Related To Charity Auctions In 2021 Charity Auction Charity Tax Deductions

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Fundraising How To S Ten Ways To Say Thank You Fun Fundraisers Fundraising Sayings

Are Raffle Tickets Tax Deductible The Finances Hub

Charitable Donation Receipts Requirements As Supporting Documents For Tax Deductible Donations Donation Letter Donation Letter Template Donation Form